Conceptually, the use of financing companies is aimed at reducing the tax burden in high-tax countries while at the same time shifting the tax substrate to a low-tax financing company.

In 2016, the EU issued an Anti-Tax-Avoidance-Directive (ATAD – Council Directive on Combating Tax Avoidance Practices), which must be implemented in the member states by 01.01.2019. Article 4 of this directive calls for the introduction of an interest barrier, the aim of which is to cover those companies that deliberately transfer their profits abroad by means of interest payments. Some countries already had an interest barrier regulation in their national tax laws on their own initiative. Such countries have until 2013 to adapt the rules to the EU interest barrier if necessary.

The rules on the interest barrier provide for an annual exemption up to which the interest barrier does not apply. The EU provides for a maximum annual tax-free amount of € 3 million; the following tax-free amounts currently exist in the listed national regulations:

Germany: € 3 million

Austria: currently no concrete limit, reclassification into equity capital possible by the tax authorities, based on the equity/debt ratio

Great Britain: £ 2 million

Ireland: currently no regulations on an interest barrier

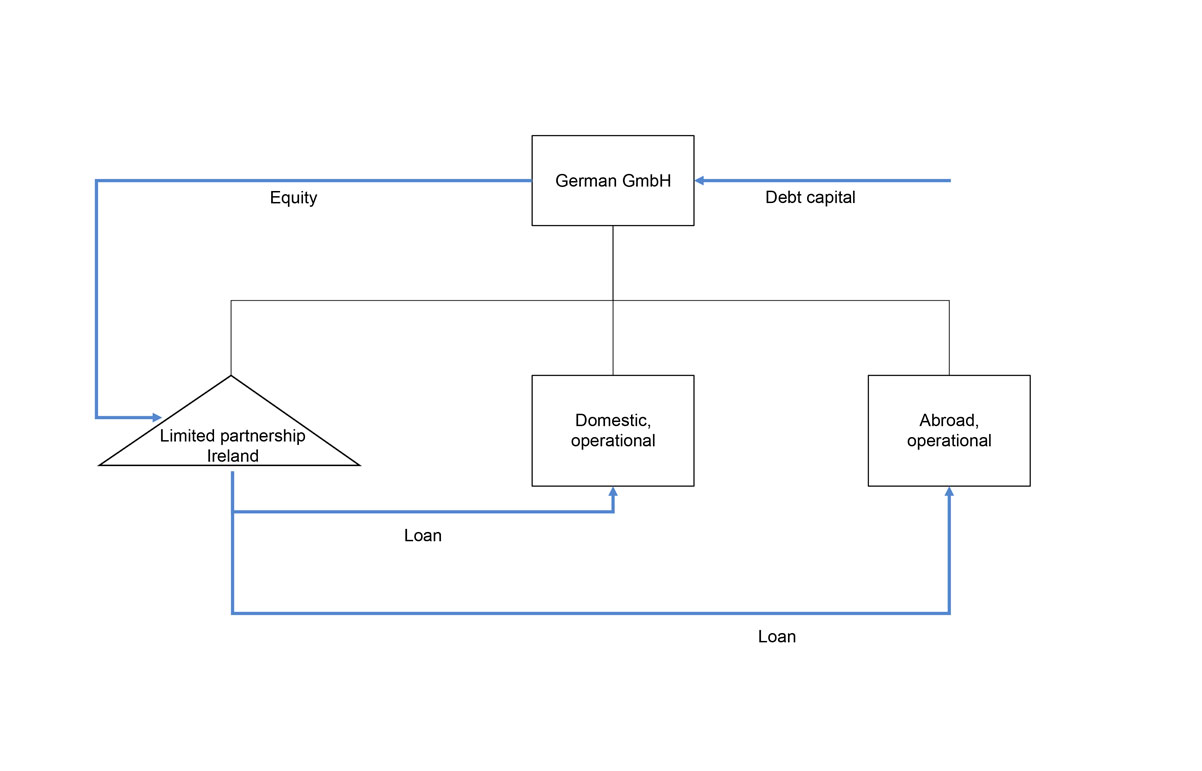

Financing with borrowed capital can be provided by a domestic holding company to foreign operating companies or by a foreign holding company to Germany.

In the following we show a simple basic case for the former situation with an Irish financing entity for the purpose of a first impression: